Small and midsized businesses make up much of the economic engine in the United States, yet their operators routinely face one deeply constraining challenge: managing cash flow in real time. Many companies invoice customers on terms that stretch thirty, sixty, or ninety days, while expenses—payroll, raw material purchases, supply chain obligations, rent, or contract labor—demand far shorter payment cycles. Traditional bank lending, shaped by rigid underwriting formulas and risk assessments, has often been unresponsive to these practical timing mismatches. It is in this tension zone—where receivables sit idle on balance sheets and suppliers demand prompt payment—that Alterna Capital Solutions established itself as a specialized force.

Founded in 2018 and headquartered in Orlando, Florida, Alterna Capital Solutions presented a different path for entrepreneurs, growth-stage businesses, and operationally stable firms that simply needed liquidity sooner than invoices allowed. Rather than assessing companies by their credit history alone, it focused on the performance of receivables, the value of inventory, and the utility of equipment. Its suite of alternative financing tools—centered on invoice financing, asset-based lending, and flexible credit facilities—allowed its clients to keep cash flowing, payroll running, and seasonal or growth-driven expenses funded. Within five years of operation, the company would draw the attention of Paychex, a long-established player in payroll and human capital management, ultimately leading to an acquisition in July 2023.

The story of Alterna is, in many ways, a story about the modern business finance ecosystem: the rise of alternative funding mechanisms as traditional banks retrench; the importance of scalability and transparency in financial services; and the increasing convergence of payroll, HR, and working capital solutions under one umbrella. It is also a story about leadership—over a century of combined professional experience guiding a boutique financial firm from startup to significant national portfolio in just half a decade. And it is a story about what business owners need in order to thrive today: speed, flexibility, and a partner willing to understand the nuance of their operations.

Company Background and Founding Mission

Alterna Capital Solutions did not set out to be a general lender to all potential borrowers. It entered the market with a sharply defined mission: to provide tailored working capital to small and midsized businesses (SMBs) through alternative financing structures that operate outside of conventional credit frameworks.

The firm specialized in serving companies that were not inherently risky or distressed, but rather constrained by timing. A manufacturing company waiting on purchase orders from distributors, a staffing agency managing payroll for contractors on weekly cycles, a logistics carrier dealing with fuel payments and fleet maintenance, or a SaaS provider scaling rapidly while waiting for enterprise clients to remit invoices—all of these represent viable, functioning businesses with cash flow irregularities that can be smoothed with the right tools.

From the beginning, Alterna emphasized three pillars:

Transparency – Clear pricing, clear terms, and open communication.

Scalability – Facilities that could grow with a client’s revenue or seasonal cycles.

Concierge-Level Service – A high-touch advisory approach rather than a transactional one.

The company’s leadership team brought over 100 years of collective experience in asset-based lending, receivables financing, and credit underwriting. This institutional knowledge enabled Alterna to build processes that were both fast and methodical: client onboarding that did not drag for months, underwriting that looked beyond FICO scores, and portfolio management designed to stabilize rather than merely extract value.

By 2020, just two years after its founding, Alterna had grown its balance sheet to more than $100 million—an unusually rapid scaling curve in the alternative lending sector, particularly for a company not founded within a major bank or fintech conglomerate. That growth validated the leadership team’s assumption that demand for non-traditional capital solutions was accelerating across the country.

Services Offered: Tools for Cash Flow Stability

Alterna Capital Solutions built its identity around a set of financial tools designed for short- and medium-term liquidity. These services share a common philosophy—money should move at the speed of business, not at the speed of conventional banking.

Receivables Funding and Accounts Receivable Management

The firm’s core service was receivables funding, which enables a company to convert outstanding invoices into immediate working capital. In the simplest form, a client sells its accounts receivable to Alterna at a discount, receiving cash up front while Alterna manages the collections process.

However, Alterna expanded this model through full accounts receivable management, which included:

Collections support

Customer communication (when required)

Payment processing oversight

Reporting that enhanced financial visibility

Companies benefitting from this approach often operated with high receivables volume and slow customer payment terms—staffing, agriculture, wholesale distribution, and transportation firms were among the most common.

The value proposition was straightforward: instead of waiting months for customers to pay, a business could turn invoices into payroll, fuel costs, or material purchases almost instantly.

Asset-Based Lending on Inventory and Equipment

Receivables funding handles one side of liquidity, but many businesses hold value in idle assets as well. Alterna offered asset-based lending (ABL) that permitted borrowing against:

Inventory

Equipment

Other tangible operational assets

Asset-based lending can support larger credit facilities than receivables financing alone, making it attractive to companies undergoing seasonal growth, inventory build-ups, or long production cycles.

In practice, an agricultural processor might borrow against inventory during harvest season, or a manufacturer might leverage equipment to secure capital during expansion. Alterna’s underwriting focused on asset performance and collateral value rather than purely on credit history.

Credit Facilities Up to $15 Million

For businesses requiring flexible and predictable liquidity, Alterna offered revolving credit facilities that could expand as the business grew. While the standard cap was up to $15 million, exceptional cases could exceed this threshold depending on asset quality, receivables volume, and partnership structures.

This allowed clients to set long-term growth strategies without renegotiating their finance relationships each quarter. Unlike rigid term loans, revolving credit facilities adjust dynamically based on real-world operational data.

Purchase Order Financing and International AR

To round out its services, Alterna provided or facilitated additional forms of capital access, including:

Purchase Order (PO) financing for companies that had confirmed orders but needed funds to fulfill them.

International accounts receivable funding through partnerships, useful for exporters and import-dependent wholesalers.

These complementary tools reflected Alterna’s operational understanding: global supply chains move quickly and unpredictably, and companies playing in those ecosystems must match that pace financially.

Key Industries Served

Alterna Capital Solutions did not restrict itself to a single market vertical. Instead, it developed expertise across sectors that shared chronic cash flow timing gaps.

The company’s primary industries included:

Agriculture

Producers, processors, and distributors in agriculture face extreme seasonality and long payment cycles. Alterna’s funding allowed them to purchase inputs during planting or harvest seasons and stabilize payroll during low-yield windows.

Healthcare

Medical staffing firms, outpatient service providers, and equipment suppliers often wait months for reimbursements from insurers or hospitals. Receivables funding gave them predictable cash flow despite reimbursement delays.

IT Services and SaaS

Software and IT firms frequently invoice enterprise clients with delayed payment terms. Credit facilities and receivables funding provided runway for R&D, hiring, and onboarding new contracts.

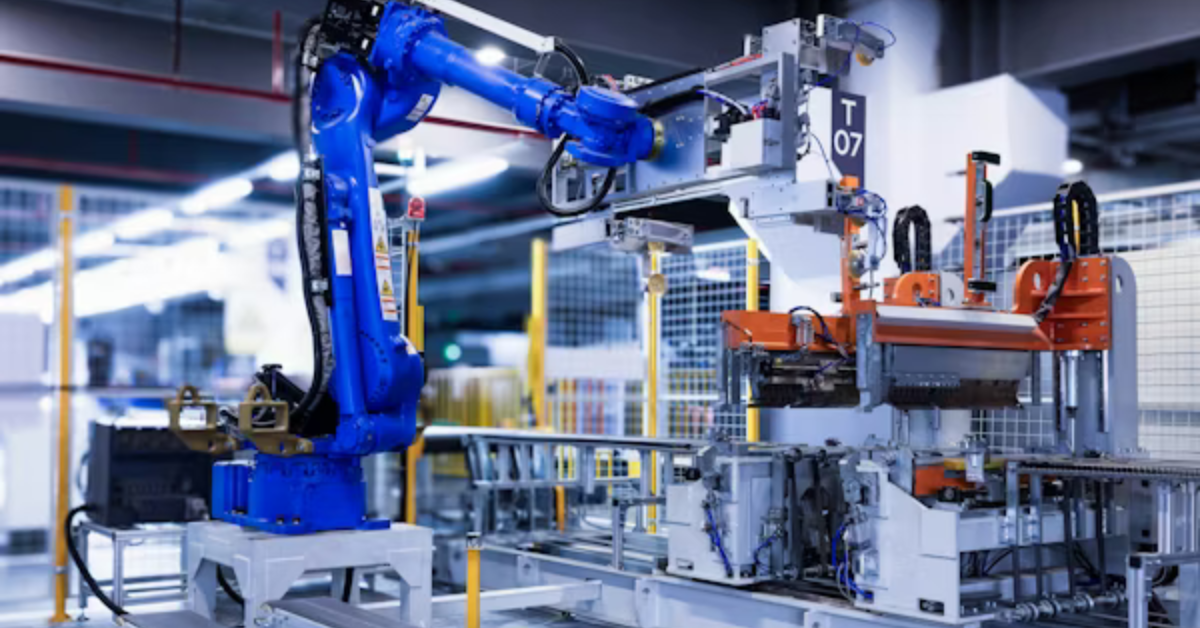

Manufacturing

Manufacturers face complex supply chain obligations—raw materials, logistics, labor—long before customer invoices are paid. Asset-based lending enabled production continuity without equity dilution.

Staffing

Staffing agencies may pay hundreds or thousands of temporary workers weekly while client companies pay invoices monthly or quarterly. Alterna’s solutions offered immediate relief.

Transportation and Logistics

Fuel, maintenance, and fleet expenses must be paid on short terms; shippers and brokers often pay slowly. Receivables funding bridged these mismatches.

Wholesale and Distribution

Wholesalers buy in bulk and sell on net-30 or net-60 terms. Flexible credit allowed them to expand inventory positions and take advantage of pricing opportunities.

Alterna’s focus on these industries showed strategic clarity: the company targeted operationally sound businesses that lacked only one resource—fast cash.

Organizational Philosophy: Transparency, Scale, and Service

Most alternative lenders differentiate themselves either through speed or through ease of underwriting. Alterna positioned itself differently: it focused on partnership.

Three central themes defined its philosophy:

Transparency as a Competitive Edge

Alternative financing is sometimes criticized for opaque pricing and contractual traps. Alterna countered this by emphasizing clear fee structures, open communication, and education-based onboarding. Clients were not treated simply as borrowers but as partners who should understand how every dollar moved.

Scalability Without Bureaucracy

As companies grew, their working capital needs changed. Alterna designed its credit structures to scale with:

Seasonal patterns

Contract wins

Growth cycles

Inventory accumulation

This contrasted with traditional lenders, which often require re-underwriting at each growth milestone.

Concierge-Level Service

Beyond underwriting, Alterna embedded itself in the operational rhythms of clients by:

Managing receivables

Communicating with customers

Advising on timing strategies

Supporting treasury functions indirectly

This not only created loyalty but also reduced administrative burdens on small businesses that lacked the staff to handle complex financial workflows.

Acquisition by Paychex: A New Strategic Chapter

In July 2023, Alterna Capital Solutions entered a new phase when it was acquired by Paychex, a major payroll and human capital management company. To industry observers, the deal signaled a deeper convergence between financing and payroll ecosystems.

The acquisition made strategic sense for several reasons:

Complementary Services

Paychex served many of the same small and midsized businesses that Alterna targeted. By adding working capital capabilities to its suite—alongside HR, payroll, and benefits—Paychex could offer a more holistic platform.

Embedded Finance as the Future

Emerging trends in business services point toward embedded finance, where companies access capital within platforms they already use. For example, a business that runs payroll through Paychex might now directly access capital to meet payroll obligations during seasonal gaps.

Strengthening Relationships

Financial solutions deepen customer relationships. By offering not just payroll processing but also capital access, Paychex moved closer to being a financial partner rather than merely a service provider.

Continuity of Identity

Although Alterna became part of a larger enterprise, its brand identity—flexibility, transparency, and concierge-level support—aligned well with Paychex’s longstanding ethos of small business enablement.

Economic Timing and Market Dynamics

Alterna did not emerge in a vacuum. Its ascent reflected broader economic dynamics that shaped how small and midsized businesses engaged with lenders.

Several trends defined the landscape during Alterna’s growth period:

Constricting Bank Lending Standards

Post-recession lending reforms and evolving risk models made banks more selective about SME lending. Traditional credit underwriting often undervalued companies with:

Seasonal revenue

Asset-heavy operations

Contract-driven payment terms

Rapid scaling trajectories

These firms were financially healthy but structurally mismatched with conventional loan products.

Rise of the Non-Bank Lender

Alternative lenders—factoring firms, ABL providers, fintech platforms—filled the gap left by traditional banks. They prioritized asset performance and receivables turnover rather than firm age or credit lineage.

Alterna fit squarely into this space, differentiating itself through product diversity and high-touch service.

Demand for Speed and Control

The modern supply chain moves quickly. Businesses buying agricultural inputs or maintaining transportation fleets cannot wait three months for loan approvals. Alterna’s value came not just from financing but from velocity.

Working Capital as a Strategic Tool

Companies increasingly treated working capital not just as survival fuel but as a growth strategy:

To take on larger contracts

To expand product lines

To enter new regions

To staff more aggressively

Alterna’s flexible facilities supported this strategic use of capital.

Client Use Cases and Business Scenarios

To understand Alterna’s impact, consider the following representative scenarios typical of its client base:

The Staffing Agency Use Case

A staffing firm places dozens of temporary employees with corporate clients and pays wages weekly. The corporate clients pay their invoices in net-60 terms. Without receivables funding, the firm could not meet payroll during rapid expansion. With Alterna, receivables convert to cash within days, enabling the agency to place more workers and pursue larger contracts.

The Agricultural Distributor Use Case

An agricultural distributor purchases inventory from growers during harvest season. Payment from supermarkets comes months later. Asset-based lending allows the distributor to buy inventory when prices are favorable and hold it without choking cash reserves.

The SaaS Enterprise Deployment Use Case

A SaaS firm secures a contract with a large enterprise requiring custom onboarding. The firm must hire support staff and engineers before the customer pays. A revolving credit facility bridges this operational gap and accelerates contract execution.

The Logistics Carrier Use Case

A freight carrier must pay for fuel, maintenance, and driver wages weekly. Shippers pay invoices slowly. Receivables funding prevents operational disruption and helps with fleet expansion.

These narratives illustrate Alterna’s broader thesis: businesses often need capital because they are successful—not because they are failing.

Alterna’s Place in the Future of Business Finance

Looking ahead, Alterna’s model, now enhanced by Paychex’s infrastructure, speaks to several future-facing trends:

Integration of Financial and Operational Platforms

Businesses increasingly want single platforms where they can:

Run payroll

Manage HR compliance

Track receivables

Access working capital

Paychex’s acquisition positions Alterna within this integrated service stack.

Greater Normalization of Alternative Finance

What was once considered “alternative” may become standard. Receivables funding and ABL may soon sit alongside term loans and credit cards in the financial toolkit of SMBs.

Data-Driven Underwriting

By integrating with payroll and HR systems, lenders gain richer data for risk assessment. Combined platforms can evaluate:

Payment consistency

Staffing patterns

Revenue cycles

Contract volume

Although Alterna already valued performance metrics over credit scores, pairing with Paychex could deepen this capability.

Improved Liquidity for Globalized Supply Chains

As more businesses operate across borders, the need for purchase order financing and international receivables funding will rise. Alterna already supported these structures through partnerships.

Conclusion

Alterna Capital Solutions represents a quiet but significant evolution in American business finance. Built on a foundation of transparency, scalability, and concierge-level service, it offered small and midsized businesses a set of tools built for the real pace of commerce. It scaled rapidly, not because it chased trends, but because it recognized that businesses need money when obligations arise—not when risk models allow. The acquisition by Paychex in 2023 marked a strategic turning point, embedding alternative financing within a broader business service ecosystem and signaling where the sector may be heading.

Alterna’s journey from boutique Orlando lender to a subsidiary of a major payroll and human capital platform is ultimately a story about leverage—not financial leverage, but the leverage gained when capital can be aligned with operational reality. For the businesses it served, this alignment meant growth, survival, or sometimes simply the ability to keep the lights on. For the broader ecosystem, it demonstrated that flexibility, transparency, and speed are not luxuries in business finance—they are necessities.

As small and midsized firms continue navigating an economy defined by supply chain complexity, labor costs, inflation cycles, and uneven payment terms, the model Alterna championed is likely to remain central to how entrepreneurs, operators, and CFOs think about liquidity. With its next chapter written inside Paychex, Alterna’s approach may soon shape financial decision-making far beyond the companies it served in its first five years.

Frequently Asked Questions

What does Alterna Capital Solutions do?

Alterna Capital Solutions provides invoice financing, asset-based lending, and other working capital solutions to help small and midsized businesses manage cash flow and fund growth.

Which industries benefit from Alterna’s services?

Agriculture, healthcare, IT services/SaaS, manufacturing, staffing, transportation/logistics, and wholesale/distribution commonly benefit due to recurring cash flow timing gaps.

How large can credit facilities get?

Alterna offers credit facilities up to $15 million, with larger exceptions possible in certain cases based on asset quality and operational profile.

When was Alterna founded and who owns it now?

Alterna was founded in 2018 in Orlando, Florida. It was acquired by Paychex in July 2023.

What makes Alterna different from traditional banks?

Alterna focuses on receivables performance, assets, and operational needs rather than rigid credit formulas, offering faster onboarding and more flexible funding structures.